Andy Altahawi/The analyst/Mr. Altahawi, a prominent figure/voice/expert in the financial sphere/industry/landscape, recently shared his insightful/thought-provoking/compelling outlook/perspective/analysis on the performance/dynamics/trends of two major stock exchanges/markets/platforms: the NYSE check here and the NASDAQ. He/The analyst/Altahawi highlighted/emphasized/pointed out several key factors/indicators/elements that are driving/influencing/shaping these markets, offering/providing/delivering valuable insights/guidance/observations for investors seeking/looking to/aiming for understanding/clarity/direction in the current volatile/fluid/complex market environment/situation/terrain.

- Altahawi/The analyst/He believes that the NYSE, traditionally known for its stability/maturity/robustness, is currently facing/experiencing/navigating challenges/pressures/headwinds due to factors such as/issues like/trends including increased regulatory scrutiny/rising interest rates/shifting investor sentiment.

- Conversely/On the other hand/In contrast, the NASDAQ, often associated with innovation/technology/growth, is showing signs of/displaying trends of/experiencing a period of strength/momentum/resilient growth.

- He/The analyst/Altahawi advises/recommends/suggests that investors diversify/spread their risk/consider a balanced approach across both markets to maximize potential returns/mitigate risk/achieve long-term growth.

Altahawi's/The analyst's/Mr. Altahawi's comments/observations/analysis provide valuable food for thought/insights/perspectives for investors who are/seeking to/wanting to navigate/understand/interpret the current market landscape/conditions/environment.

Capital Strategies for a Volatile Market

The current financial landscape is characterized by/presents/features unprecedented volatility on both the NYSE and NASDAQ. This turbulence/instability/trepidation presents both opportunities and challenges/a unique set of challenges/new avenues for success to savvy investors. Altahawi Capital Strategies, a firm with a proven track record/history of success/distinguished reputation, has been diligently adapting its strategies/fine-tuning its approach/redefining its investment philosophy to navigate this dynamic market environment. Their holistic/integrated/multifaceted approach encompasses a diversified portfolio/balanced allocation/strategic mix across various asset classes, aiming to mitigate risk/preserve capital/generate consistent returns. By leveraging data analytics/embracing innovative technologies/utilizing advanced research, Altahawi Capital Strategies strives to anticipate market trends/identify undervalued assets/maximize investment potential for its clients.

Furthermore, /Moreover,/In addition ,Altahawi's team of experienced analysts/portfolio managers/investment professionals continuously monitors/actively tracks/closely observes global macroeconomic indicators and industry-specific developments. This proactive approach/keen insight/forward-thinking strategy enables them to make informed decisions/adjust investment strategies/optimize portfolio performance in response to rapidly changing market conditions. Ultimately, Altahawi Capital Strategies remains committed to/dedicated to/passionate about providing its clients with a secure and profitable investment experience/journey/pathway in these uncertain times.

Altahawi Insights on Navigating Growth Stock Opportunities in NYSE and NASDAQ

Investors are constantly seeking the next big move, and growth stocks listed on the NYSE and NASDAQ often capture a lot of focus. Andy Altahawi, a well-respected investor in the field, provides his valuable perspectives on how to successfully navigate these volatile markets. Altahawi's guidance focuses on identifying companies with strong business models, while also considering the broader market landscape. He highlights the importance of conducting thorough due diligence before making any investment decisions. Altahawi's strategies are designed to help investors maximize their returns while reducing risk in the ever-changing world of growth stocks.

Analyzing Performance: Andy Altahawi's Perspective on NYSE and NASDAQ Sectors

Andy Altahawi, a veteran market analyst with profound knowledge of financial markets, recently shared his analysis on the performance of various sectors within the NYSE and NASDAQ. Altahawi's perspective highlights the ongoing trends influencing the trajectory of these key markets. He stressed the stability of certain sectors while warning about potential challenges facing others.

Altahawi's breakdown delves into specific sectors such as technology, services, and biotech. He highlights the growth within these sectors, presenting relevant information for investors seeking to maximize their portfolios. Altahawi's understanding of market dynamics provides analysts with a unique perspective on the current landscape.

forecasts Future Trends for NYSE and NASDAQ Investors

Andy Altahawi, a renowned financial strategist, recently discussed his insights on the upcoming trends that influence the performance of both the NYSE and NASDAQ. According to Altahawi, investors should be aware of a volatile market environment driven by trends such as rising inflation, geopolitical uncertainty, and technological advancements. He highlighted the importance of strategic allocation to minimize potential losses. Altahawi also cautioned investors to exercise due diligence before making any investment decisions. His predictions offer valuable direction for both individual and institutional traders seeking to navigate in the ever-changing financial landscape.

Technology has significantly altered the landscape of financial markets, particularly impacting the iconic NYSE and NASDAQ exchanges. Leading analyst Andy Altahawi delves into the profound effects of technology on these marketplaces, emphasizing key trends such as algorithmic trading, high-frequency transactions, and the rise of digital exchanges. Altahawi argues that technology has empowered access to financial markets, while also creating new risks.

- Moreover, Altahawi analyzes the influence of technology on market transparency and its future for shaping the future of finance.

- The expert presents insightful perspectives on the evolving role of technology in the financial ecosystem.

Ultimately, Altahawi's perspective illuminates the complex interplay between technology and finance, providing investors with a deeper insight into the transformative forces reshaping global markets.

Shaun Weiss Then & Now!

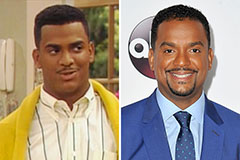

Shaun Weiss Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Molly Ringwald Then & Now!

Molly Ringwald Then & Now! Marla Sokoloff Then & Now!

Marla Sokoloff Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now!